Monument Files Lawsuit Against GoldMet and George Molyviatis to enforce Voting Agreement and Standstill

Vancouver, B.C., January 27, 2014 – Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) (“Monument” or the “Company”) announced today that it has filed a lawsuit in the Supreme Court of British Columbia (the “Court”) against GoldMet B.V. and its representative, George Molyviatis.

In its notice of civil claim, Monument alleges that GoldMet and Mr. Molyviatis are in breach of the terms of the February 17, 2013 agreement (the “Settlement”) under which GoldMet and Mr. Molyviatis agreed to support Monument, its management and its current Board of directors on all matters during the currency of that agreement. The Settlement also requires GoldMet and Mr. Molyviatis to facilitate the voting of their shares in favour of Monument’s director nominees and to not solicit proxies or attempt to influence the conduct of shareholders.

“Despite repeated requests to do so, GoldMet has refused to take the actions required to facilitate the voting of the shares as contemplated in that agreement,” said George Brazier, Monument’s Chairman. “We believe we have a compelling legal case and are moving forward to get a hearing in the Court as soon as possible, but shareholders should not depend on the Court to protect their investment.”

“Every vote we get, no matter how small, will help keep the dissidents and their supporters from taking control of your Board at the Annual General Meeting. Shareholders should follow the advice of ISS, a leading independent proxy advisor, and vote for the incumbent Board,” added Mr. Brazier.

Court relief sought by Monument

GoldMet is the largest shareholder of Monument, with 54.1 million common shares representing approximately 19.67% of Monument’s outstanding shares (the “GoldMet Shares”). Monument has asked the Court for, among other things, an order requiring GoldMet and Mr. Molyviatis to comply with the terms of the Settlement with Monument. The Settlement requires GoldMet and Mr. Molyviatis, among other things, to:

• Support Management’s nominees for the board of directors at Monument’s upcoming Annual General Meeting, scheduled for February 7, 2014;

• Not solicit proxies from shareholders of Monument, alone or in concert with others;

• Register the GoldMet Shares in the name of GoldMet and/or Mr. Molyviatis; and

• Confer upon Monument director Graham Dickson, and not anyone else, the right to vote the GoldMet Shares.

Under the terms of the Settlement, GoldMet and Mr. Molyviatis each signed an irrevocable power of attorney granting Mr. Dickson the right to vote the GoldMet Shares in support of Management’s slate of director nominees at the upcoming AGM. To avoid any uncertainty and given GoldMet’s intransigence, Monument has now asked the Court for a declaration that Mr. Dickson is in fact the only person entitled to vote the GoldMet Shares and to otherwise require GoldMet to honour the Settlement.

Monument alleges that GoldMet and Mr. Molyviatis are behind the dissident campaign

In the lawsuit, Monument also alleges that GoldMet and Mr. Molyviatis are behind the dissident campaign, contrary to the terms of the Settlement.

There are a number of reasons why Monument has come to believe that GoldMet, Mr. Molyviatis and the dissidents are connected. These reasons include:

• The multiplicity of relationships between Mr. Molyviatis and other companies he and certain of the dissident nominees have interests in;

• The immaterial ownership of the dissidents;

• The dissidents’ vague plan;

• A recent email from Mr. Molyviatis suggesting he does not consider himself bound by the GoldMet Shares voting agreement; and

• Technical maneuvering by Mr. Molyviatis in repeatedly moving the GoldMet Shares around behind the scenes so as to hide them in offshore, unidentified accounts and hence frustrate Mr. Dickson from voting them.

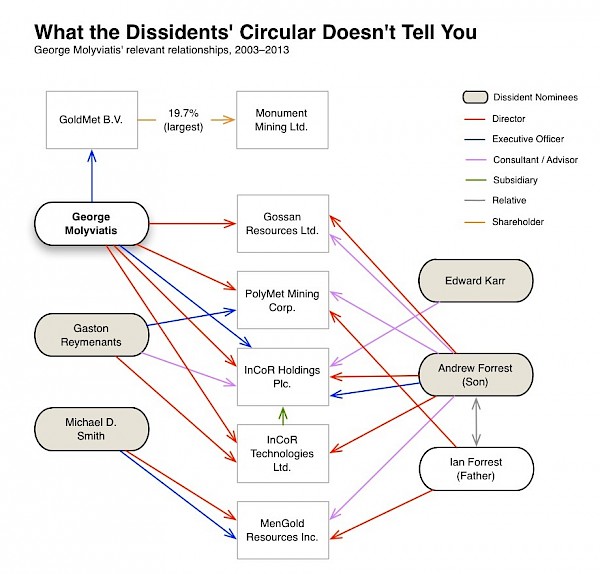

Relationships between Mr. Molyviatis and certain of the dissident group

Monument has determined that Mr. Molyviatis has direct or indirect connections to many of the dissident nominees, mainly through other companies in which M. Molyviatis has an interest, some of which are illustrated below:

The limited qualifications and negligible ownership of the dissidents and their vague plan

The limited qualifications and negligible ownership of the dissidents and their vague disclosed plan suggest they are not acting alone and have some other undisclosed master plan.

In assessing the dissidents’ qualifications, shareholders should not rely on the biographies provided by the dissidents. Monument has identified a number of deficiencies in the dissident materials and is continuing its investigation and considering possible courses of action in light of these and other deficiencies.

Following are some of the deficiencies of the dissident nominees that shareholders should be aware of:

• Avner Kreimer of Thonex, Switzerland, the dissident leader, has no disclosed experience in mining or as a director of a publicly-traded company. Mr. Kreimer is not strong on consistency. A year ago he approached Monument with a risky idea to go far afield and consider buying some mining properties in Peru that were being shopped around but were not supported by a NI 43-101 technical report. Yet now he complains about Monument’s purchase of the Murchison project on the specific grounds that it doesn’t yet have a NI 43-101 report. Murchison does have a JORC compliant resource that is presently being converted to 43-101 standard and it is a fully developed mine with all infrastructure such as mill, leach circuit, laboratory, 120 man camp and related support facilities.

• Edward Karr of Geneva, Switzerland has no disclosed experience in mining or as a director of a publicly-traded company.

• Gaston J. Reymenants of Howth, Ireland has no disclosed experience as a director of a publicly-traded company. He was rebuffed in another proxy contest where he was put up as a nominee.

• Patrick de Saint Simon of Lyon, France appears to have exaggerated the length of his service as a director of Semafo Inc. His biography says he was a director from 2005 to 2012. However, Semafo’s filings on SEDAR show that he only served on the board of that company from 2006 to 2007.

• Andrew Forrest of Nyon, Switzerland appears to have exaggerated the length of his service as a director of Buchans Mining Corp. According to his biography, he joined the Buchans board in 2009 but Buchans’ filings on SEDAR show that he joined the board only on April 30, 2010. Moreover, his biography provides no indication of the poor performance of Buchans during his term as a director, which ended on July 16, 2013. Buchans’ share price declined by approximately 67% over this period. Mr. Forrest is also listed as a director of one other publicly-traded company, Gossan Resources Ltd. Since he joined the board on October 2, 2012 the shares have dropped in value by 83%.

• Michael Donald Smith of Toronto, Ontario, the token Canadian among the dissident nominees, is 70 years old. The biography provided by the dissidents says he has “acted as a director and officer of publicly traded companies” but does not say when or name any companies for which he served as a director. According to Monument’s research, virtually all of his service as a corporate director was prior to 2000. He has not served on any boards since 2006. His last board was MenGold Resources Inc, whose stock price declined by approximately 93% from 1993 to 2006, the period for which he served as a director.

These dissidents, who seek 100% control of Monument’s Board, only own 0.058% of Monument’s shares (less than 1/17th of 1%). The cost of their proxy contest will be far more than the value of their shares, currently less than $50,000. That they would take on such an expense with so little equity and inadequate qualifications doesn’t make sense on its own, but does make sense if they have the secret support of a shareholder who has a meaningful stake and a desire to get at Monument’s cash and valuable properties.

Similarly, the dissidents’ vague plan for Monument does not make sense if they are acting on their own, because they are providing shareholders with nothing persuasive to vote for. But if the dissidents have the secret support of a significant shareholder, they might think they can win without a detailed disclosed plan, which shareholders will only find out later. We will leave it to shareholders to draw their own conclusions as to whether such an undisclosed plan is likely to be in their best interests.

Vote for Monument’s incumbent Board

While Court orders might help Monument beat back the danger, Monument urges shareholders to exercise their franchise and vote only the Management proxy in support of Monument’s incumbent eight-person board, which has been nominated for re-election. This Board intends to continue to grow the Company’s profitable mines in Malaysia and to advance its projects there and elsewhere, creating sustainable and growing value for all shareholders.

Monument urges shareholders to vote for the incumbent board members and allow them to continue to work for the benefit of all shareholders. Vote the Management proxy to keep the dissident team off of the Monument board. Don’t let dissidents seize your company and take it in unknown directions.

Institutional Shareholder Services Recommends Shareholders vote FOR all incumbent Directors

Institutional Shareholder Services (“ISS”) s a leading independent international corporate governance analysis and proxy voting firm. ISS’ recommendations are intended to assist shareholders in making choices regarding proxy voting decisions. In making its recommendations, ISS considers the outcome that is in the best interests of shareholders. ISS has recommended that its clients vote FOR all Monument director nominees. The Company advises shareholders to use only the Management proxy when voting.

For more on ISS’ recommendation, please select the following link:

http://www.monumentmining.com/s/news.asp?ReportID=620938

YOUR VOTE IS IMPORTANT. PLEASE VOTE USING ONLY MANAGEMENT’S PROXY TODAY.

Your vote is important regardless of the number of shares you own. Monument encourages Shareholders to read the meeting materials in detail. The Management Information Circular and Management’s Proxy are available on the Company’s website at www.monumentmining.com or on SEDAR at www.sedar.com.

The board of directors of Monument recommends that Shareholders vote IN FAVOUR of all proposed items.

Vote today FOR Monument’s board using only Management’s proxy

As time is of the essence, Shareholders are encouraged to vote via the internet or by telephone.

Registered Shareholders (shareholders who hold Monument shares in their name and represented by a physical certificate) may vote in person at the meeting, by mail or by using one of the following methods:

Internet: vote online at www.investorvote.com using the control number located on your proxy

Telephone: 1-866-732-8683 (toll free in Canada and US) / 312-588-4290 (international)

Facsimile: 1-866-249-7775 (toll free in Canada and US) / 416-263-9524 (International)

Beneficial Shareholders (shareholders who hold Monument shares through a bank, broker or other intermediary) will have different voting instructions and should carefully follow the voting instructions provided to them.

Shareholder Questions

Shareholders who have questions or have not received their proxy or voting instruction form may contact the Proxy Solicitation Agent below:

Laurel Hill Advisory Group

Toll free: 1-877-452-7184 (416-304-0211 collect outside Canada and the US)

Email: assistance@laurelhill.com.

About Monument

Monument Mining Limited (TSX-V:MMY, FSE:D7Q1) is an established Canadian gold producer that owns and operates the Selinsing Gold Mine in Malaysia, with production cash costs among the lowest in the world. Its experienced management team is committed to growth and is advancing several exploration and development projects in Malaysia, including the 100% owned, development stage, Mengapur Polymetallic Project. The Company employs 330 people in Malaysia and is committed to the highest standards of environmental management, social responsibility, and health and safety for its employees and neighboring communities.

Robert F. Baldock, President and CEO

Monument Mining Limited

Suite 910- 688 West Hastings Street

Vancouver B.C. Canada V6B 1P1

FOR FURTHER INFORMATION visit the company web site at www.monumentmining.com or contact:

Laurel Hill Advisory Group Toll free T: 1-877-452-7184 (416-304-0211 collect outside Canada and the US). Email: assistance@laurelhill.com.

Wolfgang Seybold, Axino AG-Europe T: +49 711-2535-92 40

wolfgang.seybold@axino.com

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward-Looking Statement

This news release includes statements containing forward-looking information about Monument, its business and future plans (“forward-looking statements”). Forward-looking statements are statements that involve expectations, plans, objectives or future events that are not historical facts and include the Company’s plans with respect to its mineral projects and the timing and results of proposed programs and events referred to in this news release. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. The forward-looking statements in this news release are subject to various risks, uncertainties and other factors that could cause actual results or achievements to differ materially from those expressed or implied by the forward-looking statements. These risks and certain other factors include, without limitation: risks related to general business, economic, competitive, geopolitical and social uncertainties; uncertainties regarding the results of current exploration activities; uncertainties in the progress and timing of development activities; foreign operations risks; other risks inherent in the mining industry and other risks described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Material factors and assumptions used to develop forward-looking statements in this news release include: expectations regarding the estimated cash cost per ounce of gold production and the estimated cash flows which may be generated from the operations, general economic factors and other factors that may be beyond the control of Monument; assumptions and expectations regarding the results of exploration on the Company’s projects; assumptions regarding the future price of gold of other minerals; the timing and amount of estimated future production; the expected timing and results of development and exploration activities; costs of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; exchange rates; and all of the factors and assumptions described in the management discussion and analysis of the Company and the technical reports on the Company’s projects, all of which are available under the profile of the Company on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.